What to do If you would like home financing and then have Unfiled Production

When you are in a position to possess homeownership but i have unfiled efficiency, you could explore your options more than, nevertheless they might cost you extra money about a lot of time run. The most suitable choice is always to deal with the unfiled tax returns.

- Assemble your documents and do your taxation statements – For people who hire a taxation pro, they will easily be capable of getting your income files regarding brand new Internal revenue service to accomplish your own income tax go back. While you are worry about-operating, yet not, just be sure to enjoy in the lender statements, sales records, and other financial data files to gather this new amounts.

- Complete the past six many years of production – It doesn’t matter how far trailing you are, you generally only need to carry out the last half dozen many years in order to get loans in Joes CO with bad credit compliant on Internal revenue service, therefore the home loan company will generally speaking want to see the past couple of years.

- Request penalty relief – When you document your own delinquent yields, you’ll bear charges. Query the latest Internal revenue service to have penalty abatement to attenuate the quantity you borrowed.

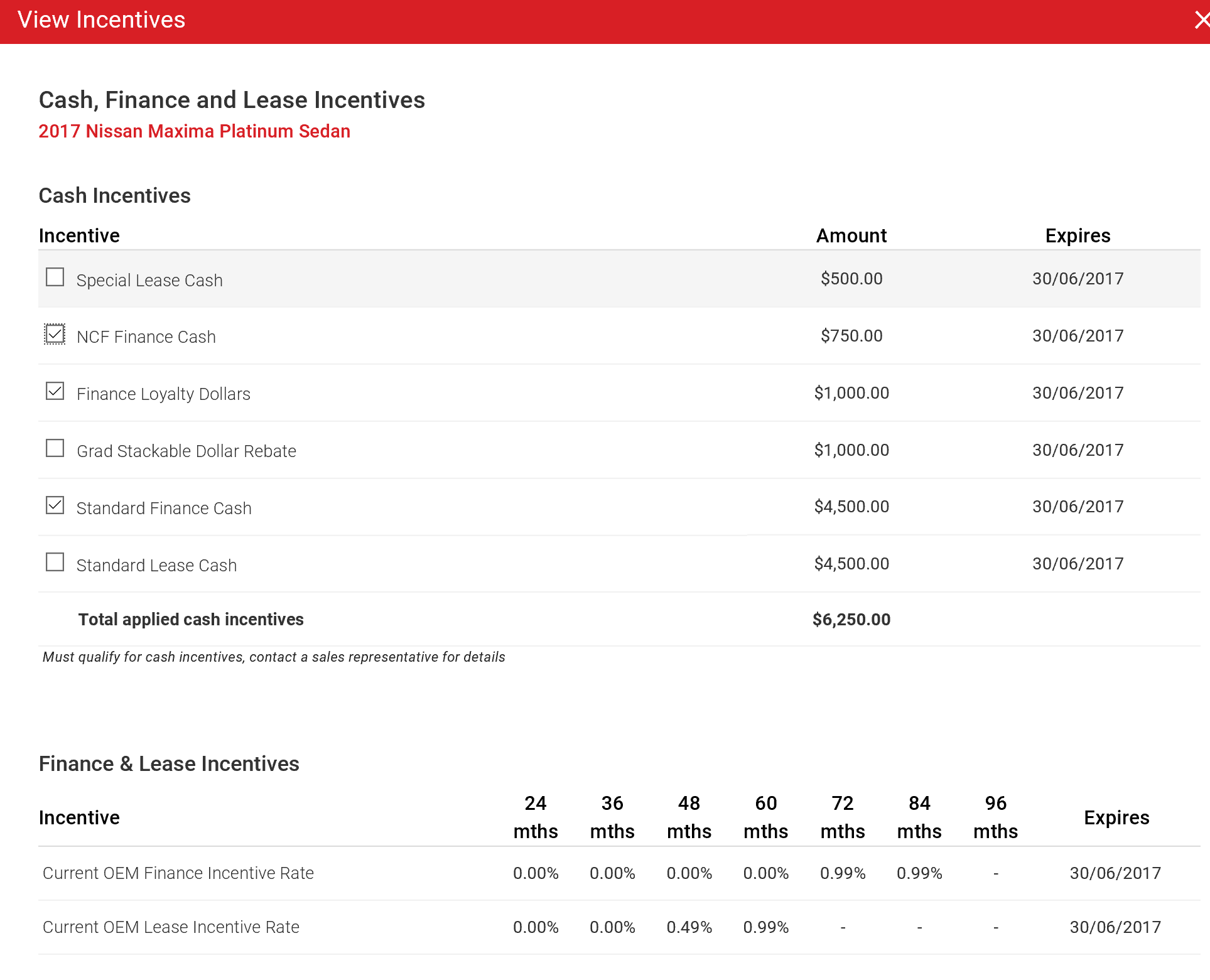

- Created payment agreements if you owe fees – If your tax returns tell you tax owed, make sure you setup a cost package the moment possible. The financial institution have a tendency to consider your month-to-month tax payments and one almost every other personal debt payments when examining your debt-to-income ratio.

- Address tax liens – In the event the Internal revenue service provides given a taxation lien against your, have them take it off. For individuals who are obligated to pay below $fifty,000, they’re going to essentially beat tax liens once you make three monthly money into the a fees contract. For folks who owe more than $50,000, you might have to have the lien subordinated before you can score a mortgage.

- Focus on your credit rating – When you find yourself talking about the unfiled tax returns, including do something to improve your credit rating. Lower credit debt and contact the credit bureaus if you’ll find any mistakes in your report. The better their score, the higher your loan words would-be.

- Save a down payment – A big down-payment will help alter your chances of success, however, if that is not you can easily, adhere to FHA, USDA, or Va loans hence all has actually lower downpayment conditions.

Remember in some cases, filing dated tax statements can also be put money into the pouch. When you have a reimbursement, you can declare that 3 years after the filing deadline. That will help along with your downpayment and possess counterbalance taxation you are able to owe some other many years.

Could you Obtain home financing When you yourself have Unpaid Fees?

For those who document your productivity and owe tax, that’ll not always stop you from qualifying to have home financing. But not, your own home loan company would like to pick evidence of the payment plan, and they’re going to capture these types of payments into account when calculating the debt-to-earnings (DTI) proportion. This new DTI conditions cover anything from lender so you can financial, however, generally, you will want to go after 36% or less than. This means that thirty six% of your own month-to-month money goes to bills as well as your taxation repayments, student education loans, car loans, the home loan, and just about every other bills you have.

Really lenders want to see which you have become making costs for most months. Whenever you are in the first or second week of cost contract, you may want to wait a bit before applying. Don’t let yourself be afraid to inquire about the borrowed funds administrator about your condition – they manage all sorts of consumers, and can give you advice on what to anticipate throughout your house-to purchase process when you yourself have outstanding taxes.

Trying to get Mortgages When you have a taxation Lien

The newest Irs also can place a beneficial lien on your own possessions if you really have unfiled output. When you never file your own productivity, the new company is also evaluate how much cash you could are obligated to pay and you may post your a costs. Constantly, that it costs is more than you actually owe, of course that you don’t perform, the latest Internal revenue service can question an income tax lien. Sometimes, even if you set-up a payment arrangement, the new Irs will nevertheless set a beneficial lien in your possessions.